President Donald Trump seems to want to have it both ways on the U.S. economy.

On the one hand, he recently said the economy is in its “golden age” and referred to the U.S. as the “hottest country anywhere in the world.”

Yet at the same time, he has outright demanded that the Federal Reserve sharply slash interest rates to fuel economic activity. And his recently handpicked governor, Stephen Miran, has led the charge in pushing for a bigger cut than preferred by his new colleagues at the Fed.

When an economy is strong, central banks typically don’t cut interest rates and may even raise them to avoid spurring inflation. And so to support his argument for large cuts, Miran has played up “downside risks” to the economy and a weakening labor market, contrasting with Trump’s talk of a “golden age.”

Trump and Miran also seem to be ignoring the problem of inflation, which the president has said “has been defeated” and Miran considers close enough to the Fed’s target of 2%. Yet, inflation remains high and has been picking back up in recent months – one of the core reasons the Fed has taken a gradual approach to lowering interest rates.

I’m a macroeconomist, which means I study big-picture factors affecting an economy, such as interest rates.

It’s well known that lower rates spur faster growth, and of course all presidents want a stronger economy on their watch. But the Fed’s job when it sets interest rates is to deal with whatever reality the data shows – and make decisions accordingly.

Is the economy hot or not?

In the simplest terms, the Fed raises interest rates when the economy is “hot,” or inflation is above the Fed’s 2% target, and lowers them when there are concerns about unemployment.

At its most recent meeting, in September, the Fed lowered rates a quarter of a point, citing slowing jobs growth, and increased economic uncertainty. Trump nominee Miran was the only one of the 12 members of the Fed’s policy-setting committee to instead vote for a more aggressive half-point cut.

The only credible rationale for that large of an interest rate cut, in the face of still-high inflation, is by believing the labor market is incredibly weak. According to the Fed’s preferred measure, the personal consumption expenditures index, inflation has been accelerating all summer and was 2.7% at the end of August, well above the Fed’s 2% target.

There’s no doubt jobs growth has slowed considerably in recent months, but enough to completely ignore the risk of driving inflation higher? At this point at least, the Fed doesn’t think so.

And if the economy were in fact running hot, as the president claims, the Fed would have little choice but to keep rates flat or raise them, especially given elevated inflation.

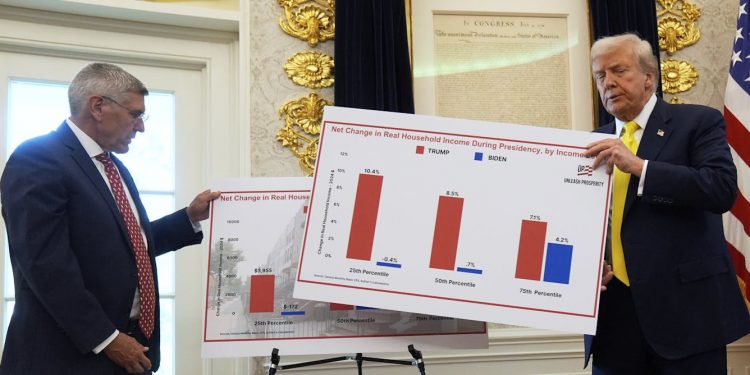

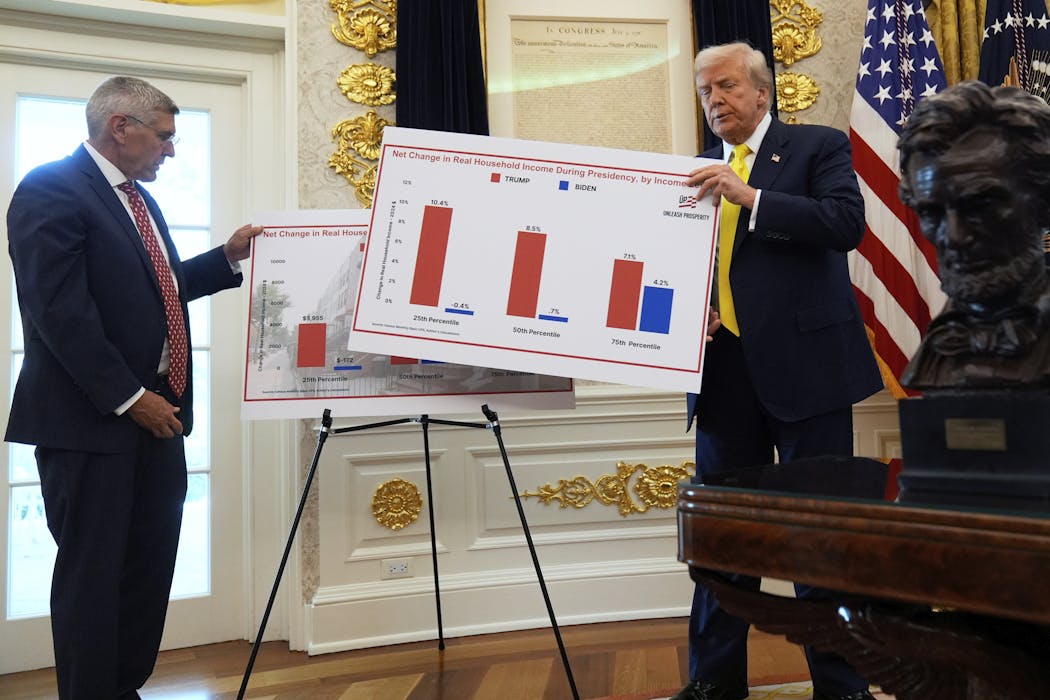

AP Photo/Mariam Zuhaib

Risks of following political whims

This situation gets at the heart of why central bank independence matters.

Trump’s efforts to influence the Federal Reserve have not been subtle and break with Congress’ intention to insulate the Fed from political manipulation. Besides pressing for big rate cuts, he has tried to fire a member of the Board of Governors over questionable allegations and mused about removing Fed Chair Jerome Powell.

The risks of following the wishes of a president in the face of what the data shows were starkly demonstrated in 2021, when Turkey’s president, Recep Tayyip Erdogan, fired the head of the country’s central bank. The central banker was pushing rates higher to tame inflation, which was at about 20%, but Erdogan demanded they be lowered. In response, Turkey’s lira plunged to record lows and inflation soared to over 70% in 2022.

Something similar could happen in the U.S. if Trump continues down the same path of meddling with the Fed. As a sign of how much Wall Street worries about this risk, a recent study estimated that if Trump followed through on his threat to fire Powell, the stock market could lose an estimated US$1 trillion as a result.

That’s because the Fed’s credibility rests on its ability to make decisions driven by economic evidence, not political expedience. That independence means policymakers must weigh data on inflation, jobs and growth rather than election cycles or partisan demands.

Justifying deeper rate cuts

Looking ahead to the Fed’s next meeting Oct. 28-29, policymakers face a delicate balancing act. With inflation still running above target and signs of slowing jobs growth, it needs to lower rates enough to prevent a downturn but not so low that inflation spirals out of control.

Traders are putting near-100% odds of two more quarter-point cuts this year, one on Oct. 29 and another in December. This would bring the Fed’s benchmark interest rate to a range of 3.5%-3.75% by the end of 2025, down from 4%-4.25% now.

Based on Miran’s own interest rate projections, he’s likely to again push for a larger cut of a half-point or more at both meetings, as he believes the Fed’s benchmark rate should be below 3% by the end of the year.

To me, as an economist, the only way a Fed acting independently could reasonably justify such a significant cut in rates in the next few months is if the unemployment rate begins rising steadily, with the economy clearly at risk of slipping into a recession.

![]()

Joshua Stillwagon was a long-time organizer and judge for an academic competition hosted at the Federal Reserve Bank of Boston, and has presented research at the Federal Reserve Bank of Boston.